Register now for Texas Clean Energy September 24-September 26, 2024 by Infocast – San Antonio

This Event Reminder is Sponsored by:

Get the Latest Insights on How Market Redesign Affects Opportunities in the Exploding Texas Clean Energy Industry!

Load growth in the Lone Star State has exceeded all expectations. Large energy users like crypto, data centers, and post-IRA manufacturing as well as the state’s rising population are creating massive load increases. Despite great uncertainty caused by the impacts of recently implemented reforms, still-to-be implemented reforms, and proposed-but-not-yet-enacted legislation, the situation holds enormous opportunities for renewables development.

To seize these opportunities, however, a deep understanding of changes ongoing in the Texas power markets is required. Business planning has never been more challenging. The best possible comprehension of numerous rule reform impacts on the Texas power grid and Phase 2 of ERCOT market redesign is essential. At the same time, developers, financiers, and other stakeholders need accurate analyses of the consequences of proposed new policies, extreme weather, and price volatility in the ERCOT market.

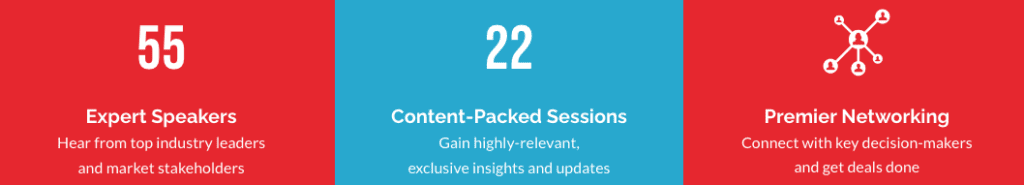

Infocast’s Texas Clean Energy Summit is the best place to meet and learn from policy makers, as well as the state’s most active developers, asset owners, QSEs, offtakers, financiers, investors, and other key players. This remarkable group will discuss the booming opportunities and looming challenges in today’s renewables environment. This is a can’t miss opportunity to get the most advanced current understanding of critical issues like:

- PCM and other ERCOT market rule changes, and how they will affect procedures, expectations, and the fundamentals that will drive the market in 2024 and beyond

- The current market dynamics, business models, and financing environment of wind, solar, storage, and hybrid projects, including how the IRA’s changes affect projects in Texas

- The new firming requirements affecting wind and solar – will this super-charge the already big storage boom in the state?

- Today’s strategies for mitigating transmission congestion and basis risk while balancing reliability issues, the integration of DERs & VPPs, and preparing for the future of the Texas grid

- The needs and expectations of large energy users and other offtaker procurement decisions, as well as how they affect the grid, financeability, load projections, and contract negotiations

- Proposed new state legislation affecting both power prices and renewables projects – hear expert opinions on timelines, potential stumbling blocks, and strategies to move projects forward

- Join key players in Texas renewable energy at the most popular event among developers for critical information and networking opportunities. Review our detailed program agenda, remarkable collection of speakers, and reserve your place today!

AGENDA:

7:30-8:30 Registration and Networking Breakfast

8:30-8:45 Opening Remarks by Executive Briefing Chair

Susan M. Shifflett, Executive Director, TEXAS HYDROGEN ALLIANCE

8:45-9:15 Keynote Presentation: What Happens When Large Energy Users (LEUs) Enter the Grid?

ERCOT is forecasting that power demand will continue to grow every year through the next decade, with much of that growth coming from large energy users (LEUs) like data centers. But when an LEU enters the grid, they often change the grid landscape, shifting basis risk and congestion and upending common assumptions used in load forecasting and managing reliability day-to-day. This Keynote explores the effects LEUs have on the Texas grid, and how assumptions should change to keep pace with both the needs of the grid and the expectations necessary to accommodate new load.

Agee Springer, Large Flexible Load Interconnection Manager, ERCOT

9:15-10:15 Panel Discussion: The Needs of Data Centers & Other Fixed Load Offtakers

With the rapid growth of the digital economy, data centers and their need for reliable, costeffective energy are proliferating in Texas. For LEUs who have fixed load, renewables can be the most cost stable source of energy, but renewable generation itself is variable by nature. How do fixed load offtakers and LEUs square that circle, what are their needs from an operational perspective, and how does the push for decarbonization drive decision-making?

• What are data centers and other large industrial customers doing to manage their energy

costs? Where is the line for cost reliability vs grid reliability?

• What are LEU renewable targets, what kinds of solutions are they looking for, and what

project characteristics appeal to them?

• Solutions in the mix: On Site/Co-location vs PPAs/vPPAs vs RECs

• 24×7 load: backup storage, islanding, microgrids, and other interruption of service strategies

• How do LEUs use paired BTM storage with existing generation to reduce coincident peaks?

Moderator:

Jeff Clark, President, ADVANCED POWER ALLIANCE

Panelists:

Bryn Baker, Senior Director – Market & Policy Innovation, CEBA

Todd Masters, Energy Portfolio Manager, COMPASS DATA CENTERS

David Miller, Vice President – Business Development, GRIDMATIC

Connor Valaik, Manager – Transactions, LEVELTEN ENERGY

10:15-10:45 Networking Break

10:45-11:45 Panel Discussion: Understanding Cryptocurrency Mining & Other Flexible Load Offtakes

5 GW of flexible load is expected to come online in ERCOT this year, with an additional 16 GW predicted by 2026. This rapid influx triggered the establishment of a Large Flexible Load Task Force to develop rules for additions to the grid, as flexible LEUs and other technologies, like hydrogen, have the potential to shave up to 1% off peak demand despite their huge increase in average load. Of all the flex load options, hydrogen could have the most impact, but who’s taking the risks and financing early projects? This panel will explore the implications and opportunities, including:

• Do current cryptocurrency valuations support the projected number of additions, and are

flex load LEUs incentivizing increased renewable deployment? What about hydrogen?

• What clean energy assets are being built to supply cryptocurrency mining facilities, and how are deals getting financed? Are offtakers technology neutral?

• What is the relationship between crypto mining, curtailment, and congestion?

• Elastic load: Demand Response, Voluntary Curtailment Program for Large Flexible Customers

During Peak Demand, and other ancillary services

• Free market system and pricing are drivers for crypto to be in TX: How might PCM and other market design reforms change that calculation, and will those incentives be affected?

Moderator:

Brock Petersen, Chief Operating Officer, SATOSHI ENERGY

Panelists:

John Belizaire, Chief Executive Officer, SOLUNA HOLDINGS

Shaun Connell, EVP of Power, LANCIUM

Matt McMonagle, Chief Executive Officer, NOVOHYDROGEN

Brad Richter, SVP of Energy, US BITCOIN CORP

Pierre Rochard, VP of Research, RIOT

11:45-12:15 Presentation: Decoding the Prevailing Wage and Apprenticeship Requirements of the Inflation

Reduction Act

The Inflation Reduction Act is a monumental investment in the expansion of clean energy infrastructure nationwide. Yet, its complexities, especially the provisions regarding prevailing wage and registered apprenticeships, have created confusion among project owners, developers, and contractors. This session, delivered by the nation’s leading apprenticeship intermediary for renewables, will shed light on related regulations and explain the roles and responsibilities of stakeholders. Learn how effective collaboration and strategic insights, businesses can mitigate potential risks and fully capitalize on benefits of apprenticeships. Join us to decode these complexities, ensuring your projects remain compliant and primed for success in the ever-evolving clean energy landscape.

Nicholas Morgan, President, ADAPTIVE CONSTRUCTION SOLUTIONS

12:15-1:45 Group Luncheon

1:45-2:45 Panel Discussion: Business Models & Financing Structures for Large Energy Users (LEUs)

As LEUs proliferate, they are increasingly adopting renewable energy for decarbonization and as a cost-effective solution to high energy demand. Whether it’s a traditional a PPA, vPPA, hedge, joint venture partnership, or vertically integrated operation, stakeholders must understand the potential revenue streams and financing implications for crypto mining, industrial facilities, manufacturing, and data centers. Each LEU will have its own priorities, needs, and creditworthiness, all of which will affect financing availability and cost.

• What are the options in the market, who’s funding them, and how are newly identified risks

being incorporated in deal structures? What’s going on in the REC market?

• How do offtake provisions, timing, and pricing structures affect financing?

• Does siting mining assets behind-the-meter affect interconnection costs?

• How are projects evaluated and how do capital fund contributions get negotiated? How is

historical power usage calculated without an actual history?

• What mitigation strategies are used to ensure future revenues will predictably cover

financing cost? What about credit-worthiness for LEUs, particularly crypto mining?

Moderator:

Barry Smitherman, Chairman, TEXAS GEOTHERMAL ENERGY ALLIANCE

Panelists:

Carl Cho, Director, Power & Alternative Energy, CORPORATE BANKING, CITIGROUP, INC.

Fred Thiel, Chairman & CEO, MARATHON DIGITAL HOLDINGS

Sondra Martinez, Managing Director, NORD/LB

Alberto Mihelcic Bazzana, Executive Director, MUFG

Allan Schurr, Chief Commercial Officer, ENCHANTED ROCK

2:45-3:15 Networking Break

3:15-3:45 Case Study: Innovative Projects: Bitdeer Rockdale Mine

Samantha Robertson, BITDEER

3:45-4:45 Panel Discussion: Negotiating the Deal: Exploring the Needs and Expectations of Developers,

Offtakers, Financiers, Tax Equity & Other Affected Parties

Offtake options and bargaining power have evolved, as construction delays, equipment issues, and covid-related market disruptions change assumptions from both a risk and cost perspective.

While decarbonization goals drive procurement decisions even as PPA prices ticked up, what new developments are being seen in LEU procurement negotiations? This session will provide an in-depth look at what’s driving procurement decisions and what risks counter-parties are willing to take on.

• How are counter-parties to PPAs, vPPAs, hedges, and other offtake agreements thinking

about risks and objectives?

• Are inflation and rising interest rates changing expectations? What about equipment costs

and the aftermath of the Dept of Commerce Investigation and Biden Moratorium?

• How sensitive are offtakers to transmission delays, and how are negotiations and provisions

changing to accommodate delays?

• How is the negotiation different when an offtaker wants both power and RECs?

• Price of RECs creating negative bids: How are corporate goals shifting priorities in deals?

Moderator:

Sarp Ozkan, VP – Commercial Product, ENVERUS

Panelists:

Joe Dillon, CEO, ADAKON ENERGY SOLUTIONS, LLC

Jonathan M. Gross, Director – Renewable Energy, MONARCH PRIVATE CAPITAL

Robert Ott, VP of Origination, NRG

Julie Thompson, Director of Business Development, C&I, ORIGIS ENERGY

4:45 Executive Briefing Adjourns

Wednesday, August 30, 2023

MAIN SUMMIT DAY 1

7:30-8:30 Registration and Networking Breakfast

8:30-8:45 Opening Remarks by the Summit Chair

Susan M. Shifflett, Executive Director, TEXAS HYDROGEN ALLIANCE

8:45-9:15 Keynote Presentation: The Impacts of Legislation & Redesign in the Texas Energy Markets

Nate Miller, Director, ENERGY AND ENVIRONMENTAL ECONOMICS, INC. (E3)

9:15-10:15 Panel Discussion: Understanding the Changes: ERCOT Market Redesign, New Legislation, and the Impacts on Renewable Projects

A wave of new bills on top of ERCOT market redesign, a delayed Phase 2 implementation, and questions surrounding the Performance Credit Mechanism (PCM): what’s going on in TX? It is crucial to understand the impacts of the new laws and rules from PCM to DRRS, particularly costs, given the scale of the changes and the move from strict market-based solutions to capacity shortfalls. This panel will examine the market re-design to date, how PCM, other new rules, and implementation timelines might affect projects in development, along with lasting impacts on the renewables markets.

• How are new laws and the redesign uncertainty impacting development, and do different

technologies carry different risk factors? Are there opportunities lurking in the grey areas?

• Reserve Margin Mandate: How is TX going to meet it? What does it mean for new projects?

What might be the effects of the $10 billion “energy insurance program”

• PCM is outside current market design: How impactful is it going to be under normal weather

vs extreme weather? Might other policies or procedures be changed to account for PCM?

• PUC, RRC, and ERCOT: what coordination between agencies needs to happen?

• Reliability: Could increasing ancillary services to meet reliability standards benefit clean

energy projects? Texas bills to bolster dispatchable power: how might this legislation affect

renewable projects?

Moderator:

Matthew Boms, Executive Director, TEXAS ADVANCED ENERGY BUSINESS ALLIANCE

Panelists:

Ned Bonskowski, Vice President of Texas Regulatory Policy, VISTRA

Mike Enger, Director – Energy Market Operations, AUSTIN ENERGY

Mark Stover, Director – State Affairs, APEX CLEAN ENERGY

Resmi Surendran, Vice President – Regulatory Policy, SHELL ENERGY NORTH AMERICA

Frank Swigonski, Director of Market Design, PINE GATE RENEWABLES

10:15-10:45 Networking Break

10:45-11:15 Presentation: The Inflation Reduction Act (IRA) & Texas: How Tax Credits & Adders Impact

Renewable Finance & Development in the Lone Star State

IRA has turned market assumptions on their head, creating both incredible opportunity and incentives for investment, but also new questions and shifting assessments on how best to maximize returns on clean energy projects. This presentation will discuss the latest trends, IRS guidance, changes to the tax equity calculations, and what it all means for Texas.

• ITC vs PTC: What makes sense? How much does locationality make a difference?

• Adders, transferability, contingents, and direct pay: How are these new provisions working

in practice, and how do projects document compliance?

• Risk vs reward: Is what we do today eligible tomorrow? What leaps of faith are happening?

• IRS Guidance: How clear is the road ahead, and are there any issues in need of further

explanation? How much risk are parties willing to take for unclear adders and incentives?

Sarp Ozkan, VP – Commercial Product, ENVERUS

11:15-12:15 Panel Discussion: Larger Projects, More Capital: TX Clean Energy Project Finance Update

Uri fundamentally changed the project finance market in ERCOT, and the market redesign and IRA tax provisions are likely to have even more profound effects. Project terms moving forward today are extremely different than even a year ago. Where do lenders see the best opportunities, and what projects and risk profiles are they looking for? How have inflation, interest rates and the IRA changed calculations? This panel will examine what makes a project financeable in the market today, including:

• Is the lack of certainty on market redesign rules affecting investor attitudes or negotiations?

• How is the IRA influencing decision-making in renewable investments, and how are the new

ITC/PTC incentives, adders, and transferability affecting financing?

• What do the forward curves tell us about the market? How is LMP and basis risk being

incorporated into financing decisions today, and might this change in the next 5 years?

• Energy only market plus ancillary service market: Who is taking the investment risk? What

incentives do merchant generators have when PCM is focusing on 30 hours and capital

investment requires price surety? Is PCM in general being accounted for by investors?

• What is the future of clean energy finance in Texas, and how are contracts evolving?

Moderator:

Blan Holman, Vice President – Regulatory Affairs, PINE GATE RENEWABLES

Panelists:

Ari Citrin, Managing Director – Utilities, Power & Renewable Energy Investment Banking,

KEYBANC CAPITAL MARKETS

Chris Diaz, Co-Chief Executive Officer, SEMINOLE FINANCIAL SERVICES

Gage Mooring, Co-Founder & Co-Chief Executive Officer, RENEWA

12:15-1:45 Group Luncheon

1:45-2:15 Presentation: ERCOT Battery Update + M&A Activity

This session will provide an update on policy, regulation, and activity in the ERCOT PV+BESS

market, with insights into the current state of M&A.

Aaron Barker, Director of Due Diligence, FRACTAL ENERGY STORAGE CONSULTANTS

2:15-3:00 Panel Discussion: Solar Development Calculations in a Tight Supply, Easy Capital Landscape

Solar production in the state has almost tripled in the past three years. While supply chain issues and inflation caused hiccups for many projects, development continues to outpace predictions, as does load growth. The opportunities for investors, developers, and offtakers in the TX markets both in and outside of ERCOT are booming. This session will examine opportunities for solar development in the changing market dynamics of today, and how the industry will evolve past 2023.

• 10 years of tax certainty: How are the IRA’s tax credits and provisions influencing TX solar?

• Potential for new solar: What is the demand and who are the customers? How is the REC market evolving, and what are the priorities of offtakers?

• How are solar developers and investors looking at cost and market redesign uncertainties, and when will that change? What about projects outside ERCOT?

• How is the solar supply chain today, and are inverter shortages swapping one problem for another? Are tariffs and inflation still influencing PPAs and other offtake agreements?

• Shoulder months: How is more solar on the grid is changing risk events with extreme volatility in pricing, and what might help to mitigate this?

Moderator:

Dino Barajas, Chair of Global Project Finance Practice Group, BAKER BOTTS L.L.P.

Panelists:

Don Curry, Chief Development Officer, OSIYO RENEWABLES

Venkatesh Inti, VP of Business Development, Q CELLS USA CORP.

John Larkey, Vice President – Power Marketing, NATIONAL GRID RENEWABLES

Beth Miletello, Key Accounts Manager, X-ELIO

3:00-3:30 Networking Break

3:30-4:30 Panel Discussion: Storage in TX: New Tax Credits, New Use Cases, New Revenue Streams

From peak shaving to frequency response, voltage support, and carbon minimization, storage has many use cases and revenue streams. However, delays are a problem: ERCOT policy updates, cost allocation consideration, lead times on transformer supplies. As prices start to lower again, storage will play a key role in TX, however that role may shift over time. While ancillary services are lucrative now, energy arbitrage values are predicted to increase as time goes on. This panel will explore storage projects today and how policy changes could move the market in new directions going forward.

• Will the PCM change the nature of the market vis a vis capacity contracts, and will that make large storage projects more financeable?

• IRA driving volatility: How might ITC/PTC create negative pricing, making storage more valuable? Have developers adjusted their approaches?

• When will new chemistries become bankable, and what kinds of programs need to be put in place to incentivize long-duration storage?

• Will financiers have an increased appetite for standalone storage projects given the IRA?

• Co-optimizing ancillary services: How can batteries be operationalized efficiently to make the most revenue?

• Cost allocation for transmission vs distribution connected batteries: What are the differences, and when will there be more certainty for distribution connected assets?

Moderator:

John Leonti, Partner, TROUTMAN PEPPER

Panelists:

Sandeep Arora, Senior Vice President – Transmission & Markets, REV RENEWABLES

Marc Atlas, CFO, AYPA POWER

Casey Keller, Founding Partner, CAERUS COMMODITIES

Oliver Kerr, Head of USA, AURORA ENERGY RESEARCH

4:30-5:15 Panel Discussion: Understanding Wind Development & Repower Opportunities in Today’s

Project Execution Landscape

TX is the largest wind energy producer in the US, but changing market design and shifting market forces have upended many assumptions for wind in the Lone Star State. The IRA, inflation, equipment and construction delays, capital cost increases, local siting issues, and congestion changes from LEUs have affected projects in unpredictable ways, while getting wind energy from generation to load remains an eternal question. This panel will explore key trends shaping the wind project execution landscape, analyze the new opportunities and challenges, and strategize lessons learned moving forward.

• 10 years of tax certainty: How are the IRA’s tax credits and provisions influencing TX wind?

How is the IRA changing new project development assumptions? What about repower?

• How is load growth affecting the wind market? Is congestion and basis risk more or less predictable than in previous years, and would offshore wind completely change the game?

• Are prices, inflation, and supply chain issues affecting corporate offtake agreements, and what are the risks offtakers are willing to take on today?

• What is happening with existing wind projects that suffered economic hardships from Uri?

• What has the past year taught the industry, and how will it continue to evolve?

Moderator:

Chris Reeder, Board Member, CLEANTX

Panelists:

Ben Fairbanks, Managing Director – Head of Wind Development, CLEARWAY ENERGY

George Hardie, Vice President – Business Development, PATTERN ENERGY GROUP, LP

David Morgan, Chief Strategy Officer, CARBON RIVERS

Matt Pawlowski, Vice President – Development, NEXTERA ENERGY TRANSMISSION

5:15-6:15 Networking Reception

Thursday, August 31, 2023

MAIN SUMMIT DAY 2

7:30-8:15 Registration and Networking Breakfast

8:15-9:15 Panel Discussion: Transmission Is Everything: Siting & Interconnection in a Fast-Paced Market with a Slow-Moving Queue

TX is facing increasing congestion at the same time as incredible load growth. Forecasting the longer-term transmission project outlook is crucial for project developers trying to profitably keep pace with demand. The need to move quickly is at loggerheads with the need for long-term evaluations to ensure the most necessary, efficacious, cost-effective projects move forward. This panel will examine the current transmission situation and potential solutions to reduce costs and risks, including:

• Legislative updates: How are planning processes changing, and are the changes a help or a hindrance to transmission buildout? How is interconnection being managed?

• Can interconnection/transmission keep up with load growth? Are expedited approvals necessary? Should more inter-regional transmission ties be built, and would that help?

• Reducing risk: What strategies are viable given the current conditions? If ERCOT shared stability data and transparency for siting projects, would that be helpful to the system as a whole? How is load balancing happening during planned maintenance?

• Where do stability limits really lie in a grid increasingly dominated by wind and solar assets?

• West TX to load: How do you move from concept to build? Can ERCOT encourage new load in areas of high congestion? How might this change common transmission problems?

Moderator:

Peter Brehm, Vice President – Government Relations, CTC GLOBAL CORPORATION

Panelists:

Madeline Gould Laughlin, Senior Manager – Regulatory Affairs, ENEL

Michael Macias, Vice President of Operations, ELECTRIC TRANSMISSION TEXAS, LLC

Brad Schwarz, Director of System Planning, HUNT UTILITY SERVICES

Ben Semmes, Project Director, GRID UNITED

9:15-9:45 Case Study: Emerging Use Cases: Dissecting an Innovative Storage Project

Andrew Waranch, Founder, President & Chief Executive Officer, SPEARMINT ENERGY

9:45-10:15 Networking Break

10:15-10:45 Presentation: Top 10 Trends in Energy Storage

Keeping up-to-date on the latest trends for mitigating risks, reducing costs, and increasing revenue is extremely important, as the role of storage expands in an increasingly volatile ERCOT market. This presentation will cover the ten most timely and impactful trends in energy storage, including new technologies, financial considerations, and procurement strategies.

Cyrus Etemadi, Vice President of Development, FRACTAL ENERGY STORAGE CONSULTANTS

10:45-11:30 Panel Discussion: Understanding & Accounting for the Growing Effects of DERs & VPPs

As ERCOT brings more renewable resources online, distributed generation plays a larger role and the market impacts need to be considered. Rooftop solar and other DERs in TX accelerated after Uri, and grow even more as retail energy costs increase. Additionally, new VPPs are gaining customers with promises of lower energy costs. But, how do DRs and VPPs affect the grid as participation in these technologies expand, and how can they be incorporated into pricing and operational models and assumptions? This panel will explore new ways for distributed solar, storage, and demand response assets to tap into the market, including the potential pathways for aggregation to enable VPPs.

• What are solar installers seeing in the resi market, and can rate design enable more participation? Are commercial customers looking for more onsite generation/BTM storage?

• What will be the impact on the distribution system, nodal pricing, and transmission costs?

• ERCOT is working on allowing DSPs and LSEs to communicate with DERs and ADERs: What will this change?

• Local incentives: What programs work to facilitate DERs and VPPs, and what’s needed?

• What combination of incentives and penalties will most effectively reward load flexibility in commercial and industrial facilities? How flexible are they really?

• What is needed to foster more widespread aggregation or virtual power plant (VPP) efforts?

Moderator:

Patrice Parsons, Executive Director, TEXAS SOLAR ENERGY SOCIETY

Panelists:

Maria Lappas, Senior Program Manager – Energy Markets, ENEL X NORTH AMERICA

Surya Mohan, Vice President – M&A and Investments, ENERGYRE

Tuan Pham, Managing Director, SILVERPEAK RENEWABLES INVESTMENT PARTNERS

11:30-12:15 Panel Discussion: The Future of the Texas Grid & How Development Keeps Up with Load

With solar proliferating across TX, wind assets being repowered, and hybrid projects on the rise, renewables are dominating in the hottest market in the country. The ERCOT market itself, the finance and investment landscape, and the changing needs of the grid all affect future planning and future profits. Price signals are quicker than development timelines and resources coming online can change not only local pricing signals, but also congestion itself. This panel will explore how the TX grid and renewable development landscape is keeping up with massive shifts in risk, pricing, timelines, weather and the myriad of other assumptions recently turned on their heads.

• How will PCM and other ERCOT market rules affect development for clean energy in both the near and long-term? If not PCM, what else is there?

• How are changes to forward pricing and energy futures affecting the bankability of projects, and what does the current uncertainty mean for projections and assumptions?

• ERCOT is going to have a duck curve like CA, when will that happen? How might planning and cost analyses be updated to account for it?

• How is variable generation being accounted for, and how big of a role will renewables play in the coming summers? What about increased issues in shoulder months?

• How can developers look ahead at where congestion and other constraints will be in the future and plan for that?

Moderator:

Chris Reeder, Board Member, CLEANTX

Panelists:

Ali Amirali, Senior Vice President, LOTUS INFRASTRUCTURE GLOBAL

Michael Eyman, Managing Director, ORIGIS SERVICES

Campbell Faulkner, Senior Vice President, OTC GLOBAL HOLDINGS

David Haug, Managing Director, ARCTAS CAPITAL GROUP

Kenan Ögelman, Vice President – Commercial Operations, ERCOT

12:15-12:20 Closing Remarks

12:20 Summit Adjourns

Recent Comments